Audit Assertions for Purchases

When the office supplies are utilized during the month an audit adjustment entry will be made to credit prepaid office. Learn faster with spaced repetition.

Inventory Audit Assertions Substantive Tests Youtube

This could be the result of intentional fraud or unintentional error in.

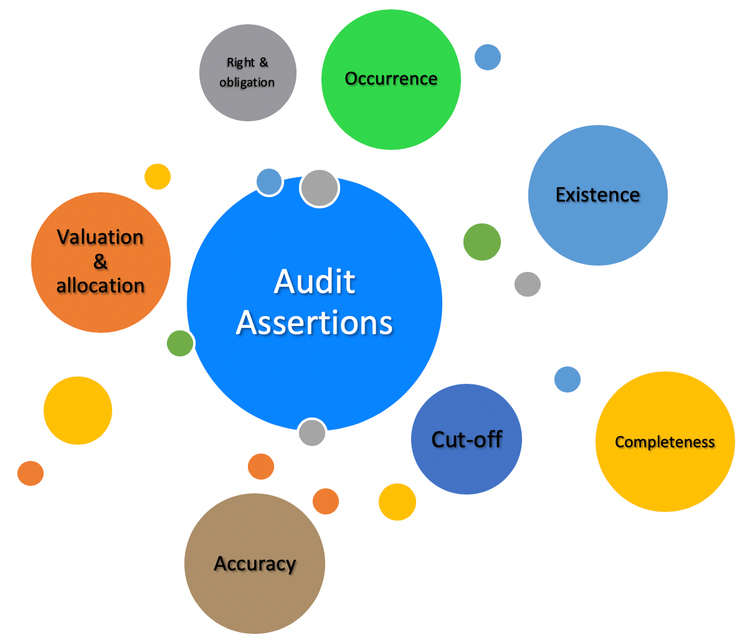

. This risk may affect a number of accounts and assertions including asset valuation estimates relating to specific transactions such as acquisitions restructurings or disposals of a segment of the business and other significant accrued liabilities such as pension and other postretirement benefit obligations or environmental remediation liabilities. The following are just a few of the possible audit standards and guidelines in the US. Put the relevant assertions next to each audit stepthis makes the connections between the RMMs at the assertion level and the audit steps clear.

The primary relevant accounts payable and expense assertions are. So the audit program should reflect steps for all. Observing the distribution of paychecks.

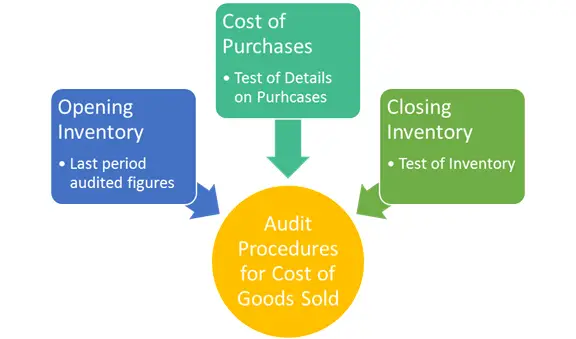

One high risk of inventory is that the company bought the inventory but the purchases were not recorded into the inventory account. Footing and crossfooting the payroll register. Entity purchases goods or renders services to run its business every day and some of those purchasing transactions are on credit while others maybe pay by cash immediatelymost of the purchases including raw materials offices supplies as well as fixed assets.

Often federal agencies offer compliance support in the form of hotlines and websites to help organizations navigate regulatory labyrinths. Here we discuss. When yu speak about audit risk at FS level you mean that all accounts separately show true and fair view but still the overall FS are misleading.

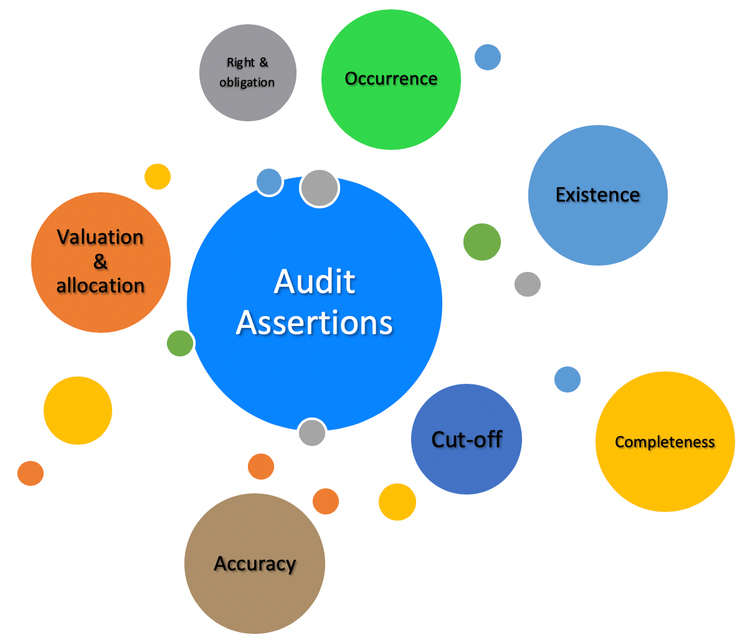

Of these assertions I believe completeness and cutoff for payables and occurrence for expenses are usually most important. Audit Evidence flashcards from Kia Raineys Florida International University class online or in Brainscapes iPhone or Android app. All of these purchasing needs to records in the entitys accounting system so.

8 Audit Risk describes audit. This has been a guide to what is a substantive audit procedure. In order to audit the accounts payable it requires to use the combination of analytical procedures and tests of detail or substantive audit procedures for accounts payable.

Inspecting payroll tax returns. When a company records its payables and expenses by period-end it is asserting that they are complete and. Profit or loss and it differs from country to country as every country has different rules and according to which every country present the income statement of the entity as per norms and.

AU-C 330 says the auditor is required to apply substantive procedures to all relevant assertions related to each material class of transactions account balance and disclosure. When you have completed this chapter you will be able to. Discuss the quality and quantity of audit evidence.

Explain the need to modify the audit strategy and audit plan following the results of. Typically we perform the audit of accounts payable in conjunction with the audit of purchases. Accounting for Credit And.

Prepaid expenses are known as assets that are being paid for and then used gradually during the accounting period ie office suppliesA company purchases and pays for office supplies and as they are consumed they will become an expense. Income Statement Formats are the Pro-forma for the presentation of an income statement which shows the result of the organization for the period ie. Definition of Income Statement Formats.

Explain why an auditor needs to obtain an understanding of internal control. For example you might have liquidity issues. The risk may also.

Subsequent cash disbursements might be sampled to test recorded accounts payable for understatement because of omitted purchases or shipping documents might be sampled for understatement of sales due to shipments made but not recorded as sales. Completeness assertion in the audit of inventory tests whether all the inventory at year-end is included in the balance sheet and all purchases and sales of inventory are recorded. The occurrences validity and existence of the transaction can be verified and the accuracy of their accounting treatment can be checked.

Explain the purpose of substantive procedures. Compliance Auditing Considerations in Audits of. When control risk is assessed as low for assertions related to payroll substantive tests of payroll balances most likely would be limited to applying substantive analytical procedures and A.

Substantive audit procedures are tests designed to collect evidence about the business transaction. Thus in this section we will take some assertions that we usually test in. Audit evaluation criteria may also change based on whether a company is public or private.

Assertions level imply accounts level you have the risk of undiscovered material misstatement of a single account or group of accounts. 18 The following paragraph is effective for audits.

Auditing Cost Of Goods Sold Risks Assertions And Procedures Audithow

How To Test For Completeness Of Purchases Or Expenses Universal Cpa Review

Understanding Audit Assertions A Small Business Guide

Audit Expenses Assertions Risks And Procedures Wikiaccounting

Comments

Post a Comment